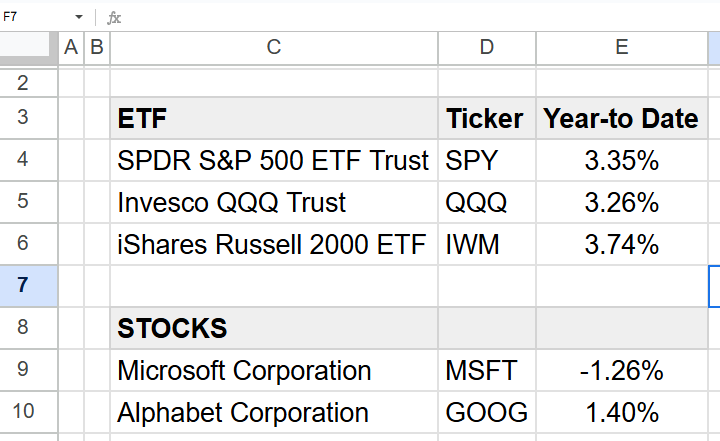

If you’re tracking the performance of stocks or ETFs in Google Sheets, calculating Year-to-Date (YTD) performance can give you a clear picture of how your investments are performing. Instead of manually calculating the change in price, you can use a custom formula that automates this process, using data from Google Finance.

In this guide, we’ll show you how to create a custom formula to calculate YTD performance for a stock using Google Finance data in Google Sheets.

Formula for YTD Performance Using Google Finance

Here’s the formula you’ll need to calculate the YTD performance for a specific stock or financial asset:

=(GOOGLEFINANCE(D5,"price")/INDEX(GOOGLEFINANCE(D5,"close","01/01", TODAY()),2,2))-1Explanation of the Formula:

GOOGLEFINANCE(D5,"price"): This part fetches the current price of the stock or asset specified in cellD5(e.g., the ticker symbol for the stock).GOOGLEFINANCE(D5,"close","01/01", TODAY()): This part retrieves the closing price of the stock on January 1st of the current year. TheTODAY()function dynamically gets today’s date.INDEX(..., 2, 2):- The

GOOGLEFINANCEfunction returns a table with multiple rows of data. TheINDEXfunction is used to extract the second row, which contains the closing price from January 1st. /...-1: The formula divides the current price by the price on January 1st, subtracts 1, and gives you the percentage change.